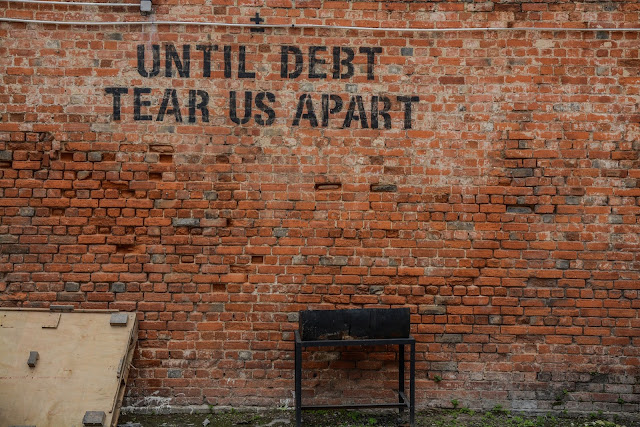

If you want to accumulate wealth you must first eliminate debt - when you constantly owe others, it very unlike that you can build a solid financial foundation. This is what I've been doing for the last few years. Eliminating those I owe. I've had to sacrifice many luxuries but my debt is down to less than what most people pay for their car. Mostly small liabilities like a student loans, doctor bills, etc.,

If you can get your liabilities in order, building wealth can surely be realized. Below, I have scratched the surface on the fundamentals to building wealth. These are the basic building blocks to obtaining your financial goals.

Wealth - Real wealth gives you options--for how you work, how much time you spend with your children & grand-children, where you travel, and when you will retire.

Actively manage your money by understanding the net-worth of your wealth-building process. Instance riches comes only to a select few, but most wealth building successes are realized after careful planning and effective management of their resources, having a goal, creating a plan, and are disciplined to execute the plan.

02/16/2018 Market Summary

Always do your due diligence and seek professionals in that field.

Top 10 Marijuana/Cannabis Stock

One of the most important concepts you'll discover is that most successful wealthy people leave the comfort of their J.O.B. and go out on their own to build their own businesses. These people achieve wealth and financial freedom because they understand that working for someone else keeps them limited from their full potential. No matter how wonderful and generous your boss may be, you can never achieve what he has until you repeat what he has done. You must build your own dream, not working for your boss’s dream!

Asset: Things you own (cash, bank accounts, 401k, investment, rental properties etc.).

Liability: Things you owe (a credit card balance, expenses, a car or mortgage note, etc.).

Net worth: The difference between the value of your assets and your liabilities.

Assets (own) subtracted by your liabilities (owe) equals your $$$net worth$$$!

Control spending: If you spend more than you pull in, say, per month this equals a negative cash-flow. Bad Budget! Budgeting your expenses gives you your 1st line of defense on where your money goes and can help you reach financial freedom. Whether you make thousands of dollars a year or hundreds of thousands of dollars a year, a budget is the first and most important steps you can take towards putting your money to work for you. Having a financial budget may help find that about 5-15% of your total spending may not be necessary .

-- Calculate what your income per month is.

-- Determine how much essentials costs monthly.

-- Determine & calculate your non-essentials monthly.

-- Spend every cent "on paper" before the next month begins

-- Give it 2-4 months to start working....starting a budget is tough if you are not accustomed to one. Save : 10% - 30% is a good place to start, but if you can't find a way to set aside 30% for your future, then start out smaller, maybe 10%, 8%, or 5%, or whatever you're able to do, but just start.

Emergency saving:

There will always be some kind of unexpected expense......ALWAYS. Car Repairs, Medical health care, etc.,

Be prepared!

This is why you want to start out at around 30% saving because you also will need to split that saving per month between these other categories.

Debt elimination: List all of your current credit cards & get them switch to the lowest interest rate you can find, consolidate if possible. But, beware you may trade lower rates for longer pay outs.

-- Negotiating with creditors for settlements is another option for debt elimination.

* Eliminate credit card usage if at all possible. *

-- Using a debit card instead of a credit card gives you all the convenience of a credit card but withdraws money immediately from your checking account, so that you do not keep digging yourself a hole.

--Talk to a specialists, such as credit counselors and financial management companies. Develop an investment strategy: When considering any investment, you should keep in mind the big picture. The objective is to ensure your financial growth and security over a long term period.

--Consult experts & do the research.

Continued growth,

Andrew Hayes

REAL TALK

"LET's DO THIS!"

Copyright © 2018 Andrew Hayes All Rights Reserved

DISCLOSURE: This post contains sponsored ads and I will be compensated if you make a purchase after clicking on links.