Photo by Olo Eletu

Anything worthwhile in life is ever free nor easy! Making money, going after goals and even planning your next vacation. All require effort........it's just how the world works.

WORK, being the keyword here. Some will shed blood, sweat & tears. Others will simply work smarter.

Many of people over the years have tried to short cut, scheme, steal their way into financial freedom. One things is for sure........many have found that in the end, it all catches up with them evenually.

As I research to procure the path to my own prosperity. When it comes to building wealth, I have come across about a dozen traits that stand out. These characteristics are common among the very successful in our society. And it should cause all that aim to succeed to take notice on how the rich build wealth and obtain success in life.

There's been a long standing motto in the entrepreneur circle.......study what your mentor does or take what the person you admire does and simple do what they do. In our case, we are studying wealth building.......

D.W.W.D. "DO WHAT the WEALTHY DO"

1) Wealth accumulation or wealth building is purely about your mindset.

Mindset - To establish a set of perspectives within ones thought process.

The mind must be focus in a positive yet passion mentality. Your mindset is not an anchored entity. It must be nourished and developed. This stimulates actions like motivation & productivity.

Wealthy people also have a leadership mindset. They only follow when they are learning. That learning turns into knowledge that transforms into wisdom. This mindset creates efficient leaders. And great leaders produce results.

In short, train your brain for complete success in the task at hand.

2) Know where you want to go!

“When you find your path, you must ignore fear. You need to have the courage to risk mistakes. But once you are on that road... run, run, run, and don't stop til you've reached its end.”

~ José N. Harris

Direction is important!

You must first know or at least understand where & why you want to go.

2) Know where you want to go!

“When you find your path, you must ignore fear. You need to have the courage to risk mistakes. But once you are on that road... run, run, run, and don't stop til you've reached its end.”

~ José N. Harris

Direction is important!

You must first know or at least understand where & why you want to go.

You don't generally step out your door, jump in car or on your bike and then travel aimlessly. You have a set place where you want to end up at. Plus, why you wanted to go there!

This is as well in wealth building......do you want to make an extra $500.00 a month? Is the goal $5,000.00 per month? Do you want assets of a million dollar by age of 40?

Define specific amounts and times, then plan to arrive at that destination!

“If you have no good drive in you, your life will not be steered through a good direction. It will miss its destined station. Passion or drive is what moves the vehicle of a fulfilled life.” ~ Israelmore Ayivor

3) Live life on your terms

How does living life on your terms relates to wealth building?

To begin with a lot of us baby-boomers were raised up with the notion that if you go to school/college, get a great job, work your way up the corporate ladder. All would lead to this awesome life. Well, reality is, it isn't a pretty ride. Often times, we are sucked into an anomaly where that J.O.B becomes Just Over Broke!

Car notes, house payments, student loans, bills bills and more bills. Before you know it your 40/50 years old and retirement is closing in fast. Where did all the years go? What happened to those dreams of travel, fine wines & epic adventures?

Car notes, house payments, student loans, bills bills and more bills. Before you know it your 40/50 years old and retirement is closing in fast. Where did all the years go? What happened to those dreams of travel, fine wines & epic adventures?

Live life on your terms means living the life that you were truly meant to live. It's is your biggest motivator. It should always inspire you to improve the quality of your life. Our life shouldn't be dictated by someone else time clock.

Life is meant to be lived. With quality time with family and friends. Travels, hobbies and a sense of accomplishments. Financial freedom provides that type of lifestyle.

Yes, live life on your terms!

4) Read, that's right read!

Every person worth more than a million $$$.....reads.

Not only is this a fact, they contribute their success to reading, a lot of reading.

"That's how knowledge works," Warren Buffett told an investment class at Columbia University. "It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it."

"Books were my path to personal freedom," Oprah Winfrey once said. "I learned to read at age 3 and soon discovered there was a whole world to conquer that went beyond our farm in Mississippi."

Reading increases knowledge, knowledge allows them to see opportunities. Reading improves their business sense, vocabulary, imagination, memory & creativity. Keeping them ahead of their competition. It also helps lower stress, while pushing you towards your goals.

READ READ READ..........!

5) Don't make excuses

Another interesting trait of successful people.......they make no excuses.

Excuses are just lies wrapped up neatly in reasons. As with any successful person, there will be failure. With a excellent leader they except responsibility. Great leadership except blame, then find ways for improvement.

"Ninety-nine percent of the failures come from people who have the habit of making excuses." ~ George Washington Carver

6) Invest

Investing is not a savings account. Investing is having your money work for you over a period of time.

Investments creates wealth, just ask Warren Buffett. Mr. Buffett, one of America's wealthiest citizen with an estimated $76 Billion worth. Did so by investing, he give us these snippets........

"Long ago, Ben Graham taught me that 'Price is what you pay; value is what you get.' Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down."

"If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value."

"Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can't produce a baby in one month by getting nine women pregnant."

Investing is a great way to beat inflation, much better than your ordinary saving account.

Invest in stocks, over say bonds, simply because over time they usually perform better and is your best shot at the highest returns.

Property investments have also proven to be fruitful for many of the successful.

Having a balanced diversified portfolio will create a higher yields while minimizing risks.

Last but not least,

An educated investor can help you reach your financial goals. The stock market has compounded wealth over the long term. And has historically doubled every 10 years.

Think long-term!

7) Triple D's

Stay focus now, get your mind out the gutter.

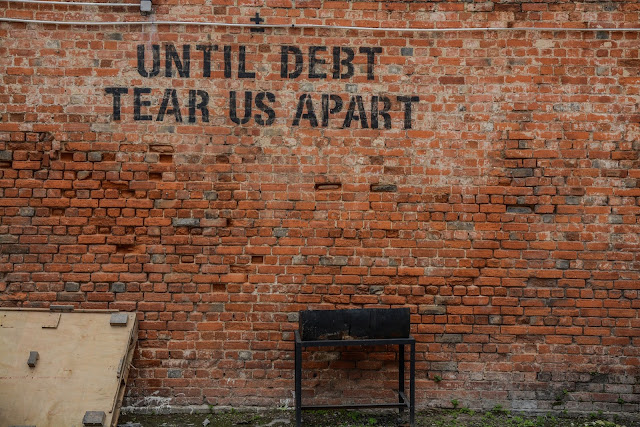

D.D.D stands for Don't Do Debt! Your biggest obstacle towards wealth building is debt. Eliminated it at all cost. If you can't pay for it in cash..........then you can't afford it!

No further explanation needed!

8) Eliminate self gratification

An important mindset that is tied in with D.D.D., is self-gratification. The indulgence or satisfaction of one's own desires.

You want it now, but you'll pay for it later. This is also a wealth building killer. Including myself, many many people remain in debt because of the urge to have it now.

Practice delayed gratification, or deferred gratification, the ability to resist the temptation for an immediate satisfaction and wait for a later reward.

Save that $5 today, have $5 next month.

Don't buy that flat screen now on your credit card @ $2,000.00 with principles over two years. Save for one year, buy the new improved model for $900.00 next year.

Invest that $1100.00!

9) Seek prosperity, abundance

Money is actually everywhere, even in bad economic times, money is out there. It's circulating some where. I was reading somewhere or heard this at a seminar. And remember this example about money:

Take an item, sale it to someone. Now there are two situations going on here right now.

Take an item, sale it to someone. Now there are two situations going on here right now.

Person 1) has money to buy or paid something.

Person 2) has something to sale.

P1) now buys or pays for a product or service somewhere. This payment has now transferred between 3 people.

P2) decides to sale that item for a profit. P2) now has a payment (money) and has put a product back into circulation.

That money is doing nothing but circulating.

I have always said to myself.....all I want to do is get caught up in that whirlpool of money. It's my version of the rich get richer. (I wrote in an earlier article......don't hate on the hustle who flips his profits.)

I have always said to myself.....all I want to do is get caught up in that whirlpool of money. It's my version of the rich get richer. (I wrote in an earlier article......don't hate on the hustle who flips his profits.)

Think BIG, Dream BIG.......Do BIG things!

10) Figure out a NEED then FULFILL it.

One way to build wealth is to create an income. We do this by starting that chain reaction mentioned above. Sale something that someone wants and supply it to them.

Supply and demand, it's been done for centuries. Provide a better product, an improved service or simply offer an outstanding value.

Find a need and fill it. ~ Ruth Stafford Peale

11) Associate with those you want to be like

If you wanted to become a baseball player, would you spend your day around people who build cars all day? Your interest is flying airplane, why would you read books about sail boats? Have you every seen a drug addict hanging around a fitness junkie? It's kind of easy to understand the simplicity of this.

You are a product of your environment. I believe it was Jim Rohn that said it best........

“You are the average of the five people you spend the most time with.”

It will be that surrounding that will shape who you are and what you'll be come.

"It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction." ~ Warren Buffet

Successful wealthy people always have MENTORS!

12) GIVE back

You go to church, you know about tithe. Which means “10% of your earnings to your church,” yet in the Old Testament, it actually was 10% paid twice a year (20%) of your crop or cattle to the land of Israel. Just a little biblical knowledge

All the same, giving back has many benefit and gratification.

This is be a conscious decision. Yet, giving is a spiritual being. Those that give back find that it does come back to them in some form.

As in tithe, when you give 10%, you are likely to receive even more back. Is this a scientific fact or simply the law of attraction?

There are however, tax-benefits as well. In most cases, one can deduct anywhere from 30% - 50% of your adjusted gross income in charitable contributions.

At the end of the day..........it's a great feeling, so give when you can 😉

The Importance Of How You Execute the First 100 Days

To the best year ever,

Andrew Hayes

P.S.

Here's a little extra $$$Bonus$$$

If anyone is SERIOUS about accomplishing great things this year, they'd be wise to come out of the starting gate fast, focused and fired up by making full use of the first 100 days.

Gary has created the most intense goal-setting program on the planet. It's all about getting massive results quickly, and starting the year fast.

The message is so simple, so powerful and so very timely. And the best part is that it has PROVEN to be one of the highest converting programs ever launched. It's both endorsed and promoted by almost every heavyweight to include Brian Tracy, John Assaraf and Early to Rise to name just a few.

Click Here To Get All Of The Details:

All the best in 2018,

Andrew Hayes

Copyright © 2018 Andrew Hayes All Rights Reserved

DISCLOSURE: This post contains sponsored ads and I will be compensated if you make a purchase after clicking on links.