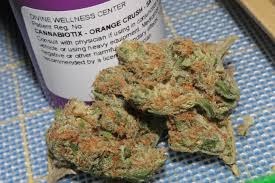

As more and more states & countries are realizing not only the medical benefits of the notorious weed. They are succumb or better yet, enticed by it's financial rewards. There are huge gains & economical advantages within it's grasp.

The tax revenues associated with the expansion of legalized cannabis has proving fruitful in every state. Colorado saw a 57% increase in state tax between 2015 & 2016. Across the board, theses states are seeing much higher tax collection than even from alcohol taxes.

Despite the nasty history this plant has had to lived with. There is no denying that the benefits of legalization of marijuana/cannabis outweighs any past negatives. As I'm sure with most of the mentality in the political world....with states that have legalized marijuana having generated some $1.5 billion in tax revenues, Money talks BS walks!

There is a business side to the medical & recreational cannabis industry. which means there is also a financial side to it as well. Now, I'm not talking about the profits or taxation of the business yet, the investment side.

As businesses develop and expand, the need for capital also increases. These legal marijuana business operate just as any other company. And just like any other company, they can be sold. Whether......you as a private citizen can own a piece of that company by buying shares or stock.

Navigating the varies options can be a little mind twisting. But, we will take one slice of that puzzle and present it to you. That option is called EFT. And they are doing very well, in the early stages of this young volatile industry.

ETF

Exchange Traded Funds - Essentially, is a group of investments packages together and traded as one on the markets. They are similar to mutual funds (kind of what you have in your 401K plan). You would buy shares of these packaged investments for long term, short sell or on margins that are within a particular index, say, the Dow Jones (DJIA), S&P 500, the Nasdaq or the Russell 2000

More popular now then they were in the early 80's when they were introduced. Most likely because they are less expensive to manage. Yet, their idea function is to trade at a consistent level as the index themselves. Meaning, fund manager use an investment strategy called Passive investing. Which tries to mimic the performance of the stocks within that particular index. For instance, your portfolio are groups of companies on Nasdaq. Whatever that market does as a whole, your fund manager will track and make adjustments accordingly. Typically, there are low turnover and lower management fees providing better returns.

ETFs To Watch For......

- American Growth Fund Series Two Class E (AMREX) $4.82 +0.06 1.26%

- Cronos Group Inc. (PRMCF) $9.31 +0.39 4.37%

- ETFMG Alternative Harvest ETF (MJX) $39.19 +0.35 0.90%

- Horizons Medical Marijuana Life Sciences (HMMJ) $23.87 +0.08 0.34%

- Tierra XP Latin America Real Estate ETF (LARE) $29.24 +0.08 0.29%

01/23/2018 Market Summary

Dow Jones @ $26.210.81 (-3.79 0.01%)

Nasdaq @ $7,460.29 (+52.26 0.71%)

S&P 500 @ $2,839.13 (+6.16 0.22%)

'HODL" On those cryptocurrencies!

ARE Alexandria Real Estate Equit ~

SYNA Synaptics Inc. ~

IBB iShare NASDAQ Biotech ETF ~

TWMJF Canopy Growth corp ~

KEYS Keysight Technologies ~

'HODL" On those cryptocurrencies!

- Bitcoin - $10,876.65 -0.80% (24 hr. Change)

- Bitcoin cash - $1,613.13 -1.09%

- Ethereum - $986.84 -1.46%

- Ripple - $1.35 +1.42%

- Litecoin -$177.64 -0.58%

- Neo - $122.20 +0.03%

- Cardano - $0.560 -1.84%

My next 5 of 20 companies that I am researching in 2018. These are not recommendation as stated, yet, are companies within industries that I feel are worthy of potential gains

ARE Alexandria Real Estate Equit ~

SYNA Synaptics Inc. ~

IBB iShare NASDAQ Biotech ETF ~

TWMJF Canopy Growth corp ~

KEYS Keysight Technologies ~

| COMPANY | LAST | CHANGE | % |

|---|---|---|---|

| AMBA Ambarella Inc | $55.52 | +0.78 1.51% | |

| ACBFF Aurora Cannabis Inc | $11.94 | +0.29 2.48% | |

| AVAV AeroVironment Inc | $52.94 | -0.13 0.24% | |

| EXEL Exelixis Inc | $30.40 | +0.96 3.26% | |

| A Agilent Techn. Inc. | $73.44 | -0.03 0.04% | |

| HIMX Himax Techn. Inc. | $9.20 | -0.22 2.35% | |

| HTC HTC Corp | $69.40 | +0.10 0.14% | |

| RIOT Riot Blockchain Inc | $19.60 | +0.12 0.62% | |

| SIEB Siebert Financial Corp. | $11.51 | -1.03 8.21% | |

| STM STMicroelectronics | $24.60 | -0.32 1.26% | |

| ARE Alexandria Real Estate Equit | $127.67 | +0.35 0.27% | |

| SYNA Synaptics Inc. | $44.90 | -0.45 0.99% | |

| IBB iShare NASDAQ Biotech ETF | $116.81 | +1.29 1.12% | |

| TWMJF Canopy Growth corp | $29.49 | -0.56 1.86% | |

| KEYS Keysight Technologies | $46.55 | +0.08 0.18% | |

| VFFIF Village Farms International | $7.16 | +0.15 2.11% | |

| O A Orbital ATK Inc. | $132.47 | -0.26 0.20% | |

| VRTHF Veritas Pharma | $0.62 | -0.01 1.20% | |

| VTC Vertcoins | $4.30 | -4.23% | |

| VUZI Vuzix Corp. | $9.95 | +0.70 7.57% |

| COMPANY | LAST | CHANGE | % |

|---|---|---|---|

| ResMed | $100.35 | + 12.73 14.53% | |

| Mattel Inc. | $17.76 | + 1.67 10.38% | |

| Netflix Inc. | $250.29 | +22.71 9.98% | |

| Travelers Companies inc. | $143.26 | +7.00 5.03% | |

| Range Resources Corp | $17.33 | +0.77 4.65% | |

| SCANA Corp | $41.16 | -2.18 5.03% | |

| Johnson & Johnson | $141.83 | -6.31 4.26% | |

| Procter & Gamble CO | $89.05 | -2.82 3.07% | |

| Allstate Corp | $101.25 | -3.18 3.05% | |

| Ultra Beauty Inc. | $228.79 | -6.22 2.65% | |

"LET's DO THIS"

Copyright © 2018 Andrew Hayes All Rights Reserved

DISCLOSURE: This post contains sponsored ads and I will be compensated if you make a purchase after clicking on links.